Bitcoin 101: A Beginner’s Journey Into the World of Digital Money

Bitcoin 101 isn’t just a tech phrase—it’s the beginning of a story that’s still unfolding. For those just starting to explore this digital frontier, Bitcoin can feel complicated, abstract, or even intimidating. But at its heart, it’s based on a surprisingly simple question: What if money didn’t need banks?

Since its quiet arrival in 2009, Bitcoin has steadily grown from an online curiosity into a financial tool discussed in government offices, global markets, and everyday conversations. And yet, many people still feel unsure about what it really is, or why it matters.

Let’s take a beginner-friendly look at Bitcoin 101—starting with what it is, how it works, and why it’s often at the center of discussions about the future of money.

What Is Bitcoin, Really?

Credit from Stocks Mantra

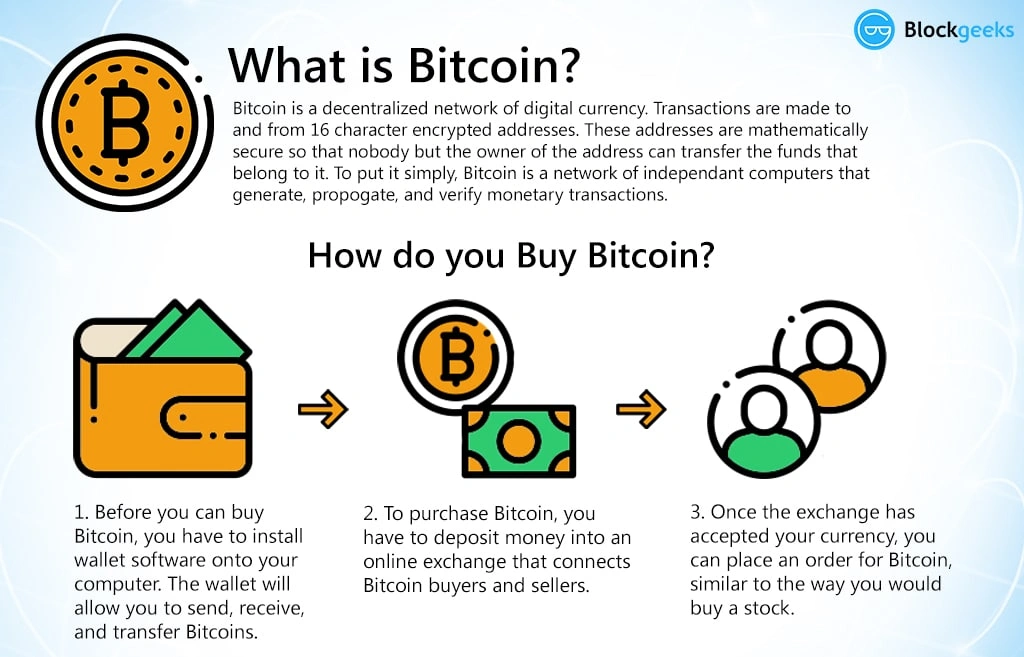

At its simplest, Bitcoin is a form of digital currency. There are no coins to hold or bills to print. It exists only online, stored in digital wallets and traded through a network of computers.

But Bitcoin is not just another app-based way to pay. It’s different from the money in your bank account because no single authority—no central bank, no government, no company—controls it. That’s a major shift in how we think about financial systems.

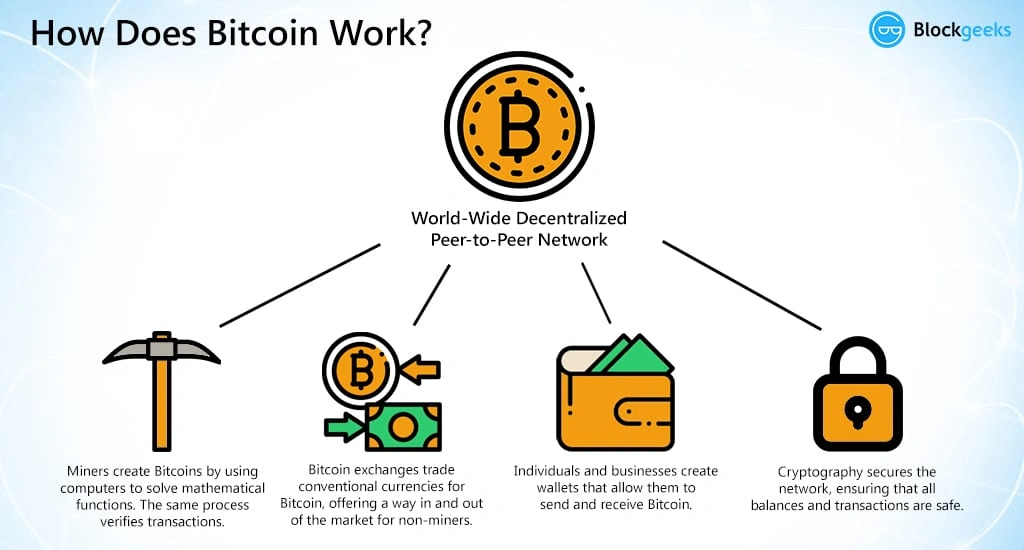

Instead of being issued by a central bank, Bitcoin is created through a process called mining, and its transactions are recorded on a public, unchangeable ledger called the blockchain. Every time someone sends or receives Bitcoin, that activity is stored on the blockchain, creating a permanent history of who transferred what, when.

How Bitcoin Works: Understanding the Basics

Credit from Stocks Mantra

To understand Bitcoin, imagine an online spreadsheet that records every single transaction ever made. But this spreadsheet isn’t owned or managed by one person—it’s copied across thousands of computers all over the world. Everyone agrees on what it says, and no one can change the past without everyone else’s approval.

That’s the blockchain.

When you send Bitcoin, you’re signing a digital message that says, “I’m giving this amount to that person.” That message is verified by the network and added to a block of other transactions. Once that block is accepted, it’s added to the chain, and the process continues.

This setup means:

- No one can secretly change the records.

- No one can duplicate coins or spend them twice.

- You don’t need a bank to make the transaction happen.

It’s a system built on transparency, math, and code—not on institutions or trust.

What Gives Bitcoin Its Value?

Credit from Investopedia

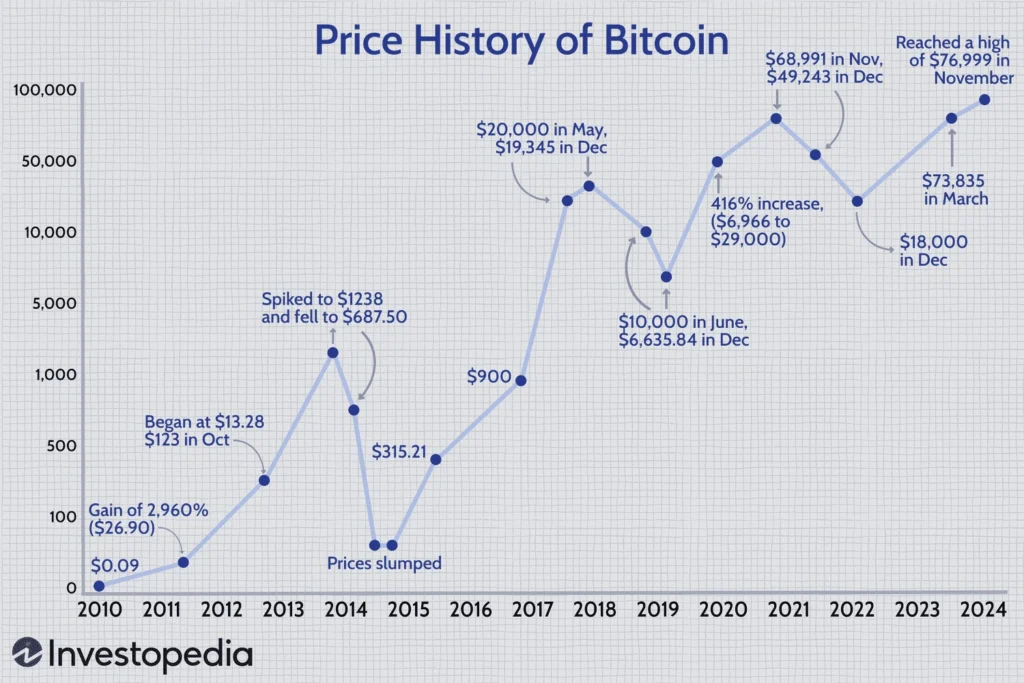

Unlike national currencies, Bitcoin isn’t backed by a government or tied to a country’s economy. Instead, its value comes from a combination of scarcity, usefulness, and market demand.

There will only ever be 21 million Bitcoins. That number is fixed in its code, making it a limited resource—similar to gold. Because of this, many see it as a hedge against inflation or financial uncertainty.

Bitcoin’s value also reflects its utility. It allows fast, borderless, and relatively secure digital payments. And as more people adopt it—whether for investment or as a payment method—its value tends to grow with demand.

But that also makes it volatile. Prices can swing wildly in short periods, driven by news events, regulation changes, or shifts in investor sentiment.

Getting Started: Wallets, Keys, and Exchanges

To use Bitcoin, you’ll need a digital wallet. Think of it like a digital bank account, but one that only you control. Your wallet stores two important codes:

- A public address, which you can share to receive funds.

- A private key, which you use to send Bitcoin and must keep secret.

There are different types of wallets—some are apps on your phone, others are hardware devices you plug into your computer, and some are web-based platforms with account access.

To buy Bitcoin, most beginners use crypto exchanges—online platforms where you can exchange regular currency for Bitcoin. These exchanges often require ID verification and work similarly to stock trading apps.

It’s possible to buy whole Bitcoins, but more often, people purchase fractions, known as Satoshis. Just like cents in a dollar, a single Bitcoin can be divided into 100 million Satoshis.

Is Bitcoin Safe? What Are the Risks?

Bitcoin’s technology is remarkably secure, but the way you store or access it matters just as much. If someone gets your private key, they can take your Bitcoin—and there’s no “reset password” button.

There’s also no government safety net. If an exchange is hacked, or you send Bitcoin to the wrong address, there’s no central authority to help you recover it.

Then there’s the price volatility. Bitcoin’s value can change quickly, and while some see it as an investment, others view it as a risky asset best handled with care and only as a small part of a broader financial plan.

Why People Are Paying Attention to Bitcoin

For some, Bitcoin is a tool for financial freedom. In countries where local currency is unstable or banking access is limited, Bitcoin offers a way to preserve value and transact across borders.

For others, it’s a long-term investment—a modern alternative to gold, held in the hope that its limited supply will push its price higher over time.

And for many, Bitcoin represents something even bigger: a possible reimagining of how value is stored, transferred, and recorded in the digital era. Its underlying blockchain technology has already inspired innovations in areas like finance, supply chains, voting systems, and digital identity.

Looking Ahead: Bitcoin and the Future of Finance

Is Bitcoin the future of money? That question is still open. But one thing is clear: the conversation about money is changing.

Banks, governments, and tech companies are exploring Bitcoin and the blockchain technologies that power it. New products like Bitcoin ETFs, crypto debit cards, and blockchain-based apps are expanding its reach beyond early adopters and tech circles.

At the same time, regulation and public education are catching up—slowly. As these systems mature, Bitcoin may continue to shift from speculation to utility, from novelty to infrastructure.

Bitcoin 101: Final Thoughts for First-Time Explorers

For beginners, Bitcoin 101 isn’t about mastering every technical detail—it’s about gaining a solid, working understanding of what it is, how it works, and what role it could play in your financial life.

Whether you’re curious, skeptical, or somewhere in between, Bitcoin invites a new way of thinking about money: one that’s digital, decentralized, and open to anyone with an internet connection.

And that’s where all journeys begin—not with certainty, but with curiosity.